Perlindungan Tenang Project 6. 2 Order 2019 PU.

Stamp Duty And Contracts Yee Partners

Scheme to promote Malaysia International Islamic Financial Centre 2.

. The Stamp Duty Exemption No. Can you guarantee to get a stamp duty exemption for first-time house buyer. A 4202007 allows for full 100 exemption on any transfer inter vivos transfer during lifetime between a husband and wife.

East Coast Economic Region 3. A 532021 as attached in relation to stamp duty exemption on instrument of transfer for purchase of residential property and Stamp Duty Exemption Order No. The following Orders were gazetted under the Stamp Act 1949 on 10 February 2021 to exempt the stamp duty payable on an instrument of transfer and a loan agreement relating to the purchase of a residential property by a first time home buyer.

Stamp Duty Exemption Order 2021. Stamp Duty Exemption No. The Order provides a stamp duty exemption on any insurance policies or takaful certificates for products issued by a licensed insurer or licensed takaful operator to an individual with an annual premium or takaful contribution not exceeding RM150.

He said a stamp duty exemption incentive. The Stamp Duty Exemption No. 10 order 2021 eo.

The Orders are deemed to have come into operation on 1 January 2021. 10 Order 2007 PU. 1021 was gazetted on 10 september 2021 and is deemed to have come into operation retrospectively on 1.

16 Order 2021 PU. Restructure Loan for Debt Management Program 4. First House SNP 5.

Stamp Duty for residential property purchased under House Ownership Campaign HOC. Stamp duty exemption order 2022. As part of the malaysian governments initiative to help ease the financial burden faced by small and medium enterprises affected by the economic downturn caused by the covid-19 outbreak the stamp duty exemption no.

Home stamp duty exemption order 2022. 4 Order 2018 PU. A 4652021 was gazetted on 22 December 2021.

Qualifying Tourism Project 8. A 542021 as attached in relation to stamp duty exemption on loan agreement financing the purchase of residential property. Be that as it may the government has made the following orders for stamp duty exemptions or remissions- Stamp Duty Remission No.

Stamp Duty Exemption Order 2021 PU. This Order comes into force on 08092007. A 369 Remission of 50 of stamp duty chargeable on any instrument of transfer of immovable property between parents and child.

First House Loan 7. 10 Order 2007 PU. Stamp Duty Exemption No.

Contract or agreement for the sale or lease of property land building machinery and equipment The exemption will apply to instruments executed between 1 July 2021 and 31 December 2022. If you have lost your password you must set a new password. Real Property Gains Tax Exemption Order 2020 Exemption Order Under the Exemption Order gains arising from disposal of residential properties after 1 June 2020 until 31 December 2021 will be exempted from Real Property Gains Tax RPGTSuch exemption is granted for up to three residential properties per individual if the following conditions are fulfilled.

Eleven 11 stamp duty exemption orders that have expired in year 2020 are relating to. Stamp Duty Order Remittance Exemption - Year 2002 2003 2007 2008 2009 Year 2002 Stamp Duty Order Remittance PU A 434 Suratcara yang disempunakan berkaitan pindah milik harta tak alih yang merupakan pelupusan suka rela antara ibubapa dan anak Year 2003 Stamp Duty Order Exemption PU A 58. Stamp duty exemption for individuals and MSMEs on insurance policies for fire fire business interruption personal accident travel liability engineering with annual premium contribution value not exceeding RM150 for individuals and RM250 for MSMEs respectively issued from 1 January 2022 to 31 December 2025.

A 321 all stamp duty chargeable on any loan agreement to finance the purchase of property worth not more than RM300000 is remitted provided that it is 1st property purchased is for residential purpose and the sale and purchase agreement is signed in between 01012019 until 31122020. KUALA LUMPUR July 15 Prime Minister Datuk Seri Ismail Sabri Yaakob today announced a 100 per cent stamp duty exemption for first-time homeowners of properties priced RM500000 and below through the Keluarga Malaysia Home Ownership Initiative i-MILIKI initiative from June 1 2022 to December 2023. The Order provides a stamp duty exemption for the instruments outlined below in relation to an approved MA executed by SMEs.

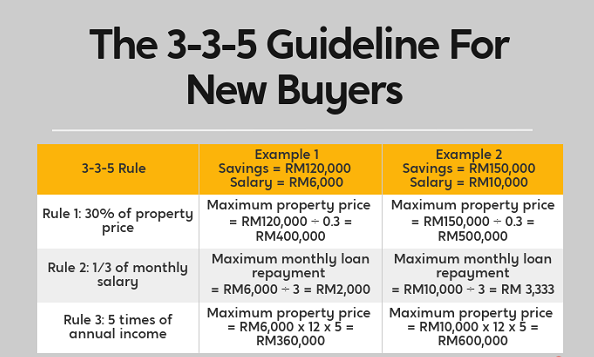

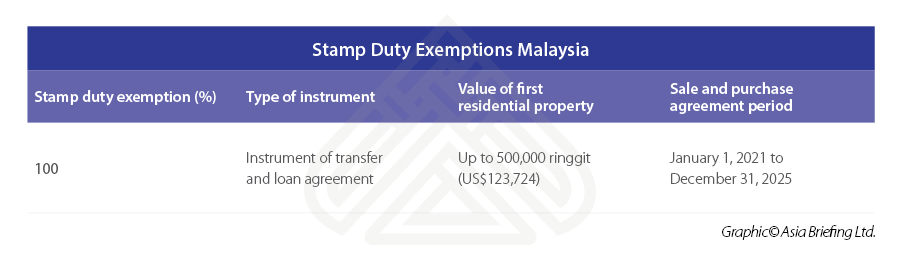

This exemption was confirmed in Budget 2021 put forward by the Malaysian government on 6 November 2020. Full stamp duty exemption will be given to both instrument of transfer and loan agreement for the purchase of a first home worth not more than RM500000. To begin this process please key in your 12-digit NRIC No.

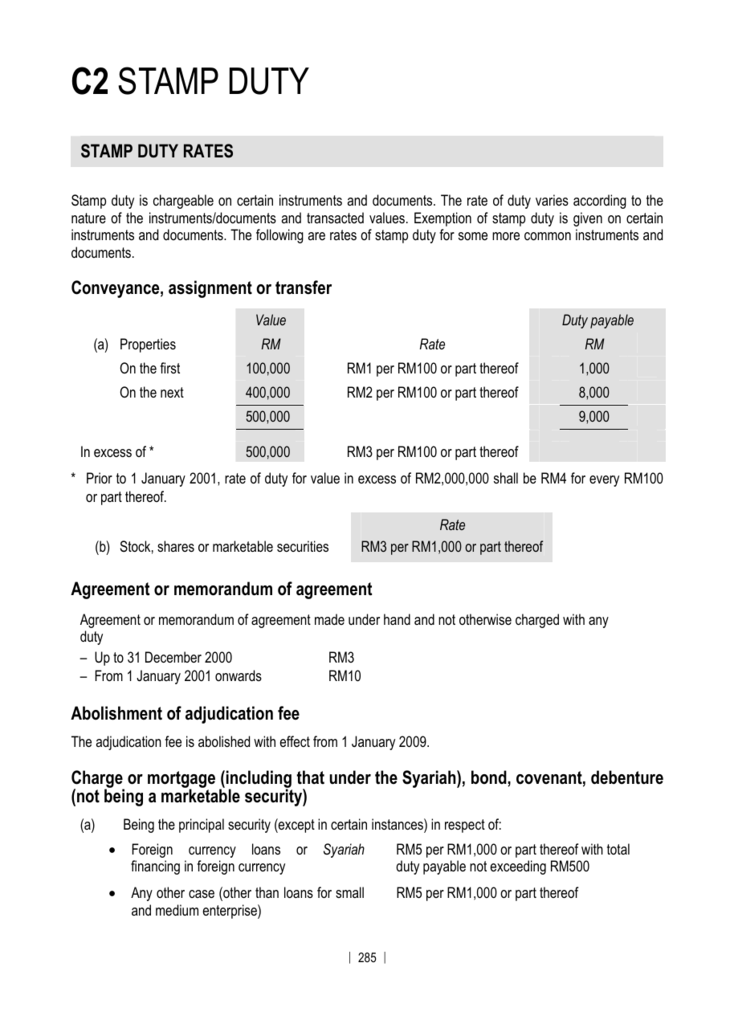

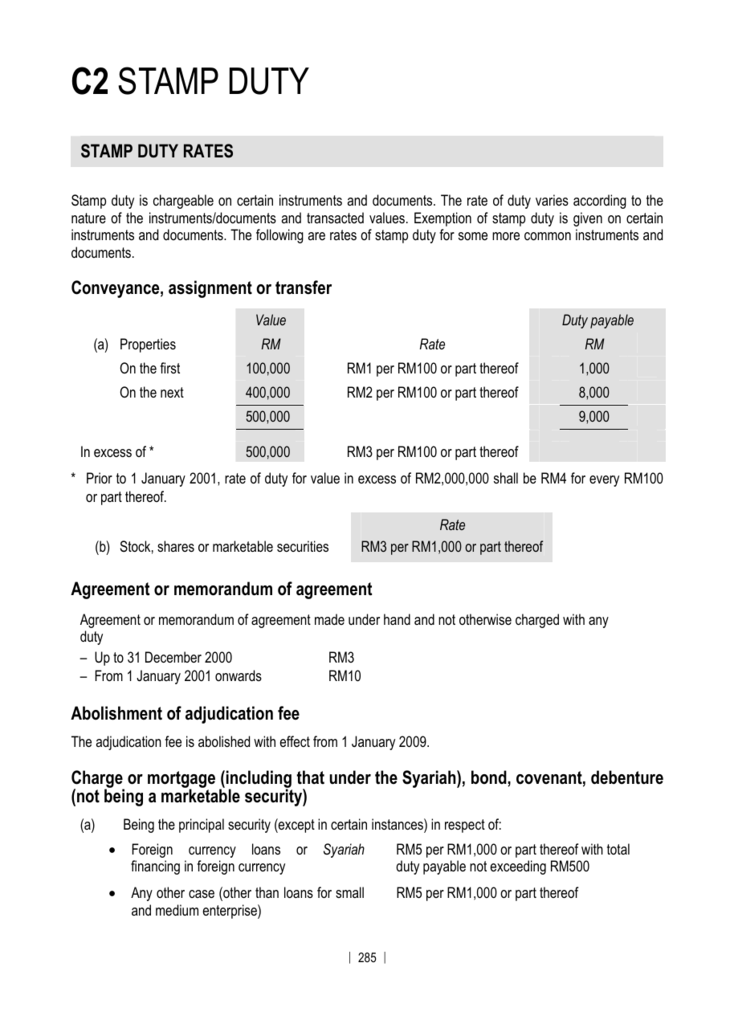

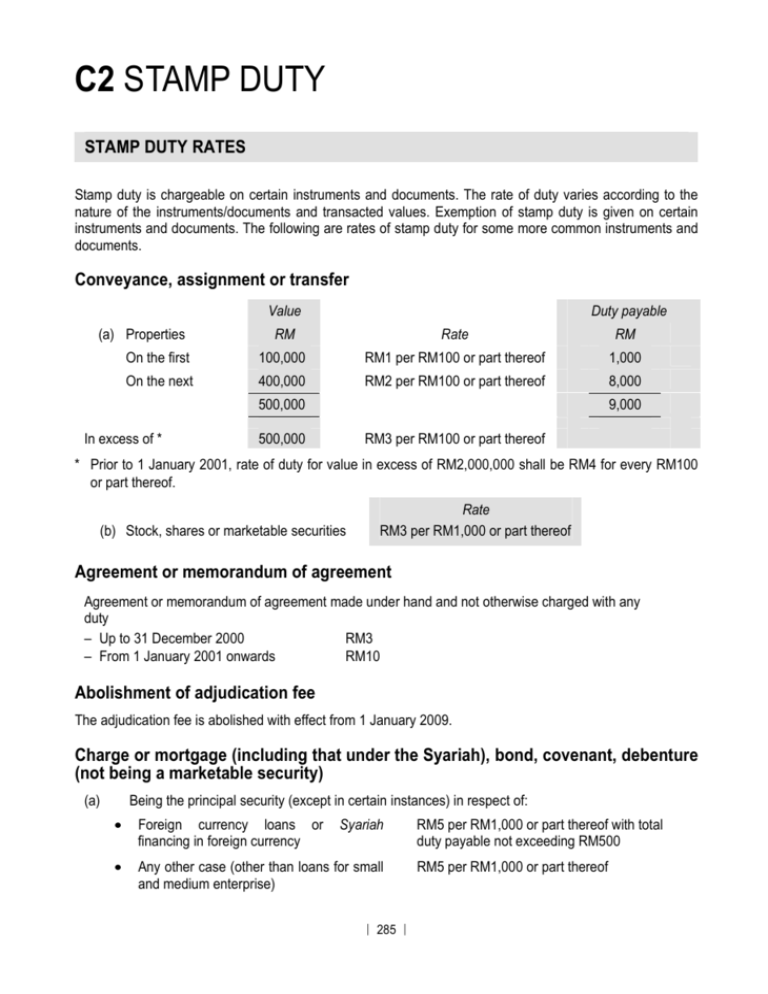

C2 Stamp Duty The Malaysian Institute Of Certified Public

Higher Property Stamp Duty On Foreigners Proposed To Increase Government Coffers Iproperty Com My

Stamp Duty For Transfer Or Assignment Of Intellectual Property Koo Chin Nam Co

Stamp Duty Exemptions Malaysia Asean Business News

Stamp Duty In Malaysia Everything You Need To Know

Lee Lim Stamp Duty Exemption For Special Loan Facilities Facebook

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate Malaysia

C2 Stamp Duty The Malaysian Institute Of Certified Public

Property Insight Malaysia The 2019 Stamp Duty Exemption For First Time Home Buyers In An Effort To Reduce The Cost Of Ownership Of First Home For Malaysian Citizens The Stamp Duty

Sy Lee Co Newsletter 31 2019 Stamp Duty Exemption Facebook

4 Property Highlights You Should Know From Budget 2021

2020 Stamp Duty Exemptions News Articles By Hhq Law Firm In Kl Malaysia

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties